Articles: China and Russia are building a common international financial framework to end US dominance of world finance, following the 2008 financial crisis and the emergence of the dangers of US dependence and Washington’s use of economic instruments as a political weapon.

American-centered financial architecture is no longer sustainable. The White House has lost control of its negative trade balance, its debt spiral is out of control, and rampant inflation is destroying its currency.

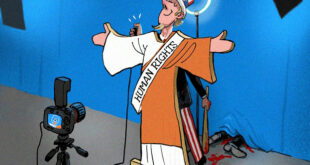

Such economic tools of power enable Washington to build an empire. It can manage huge trade deficits, collect data on its enemies, treat its allies well, and defeat its enemies with sanctions.

Earlier in the week, Russian President Vladimir Putin held extensive talks with his Chinese counterpart Xi Jinping, and leaders of the two countries discussed plans to establish a joint financial framework. They reached a new international agreement.

China and Russia have been moving toward such measures since the global financial crisis in 2008 exposed the dangers of over-dependence on the United States. However, US economic sanctions against Moscow and Beijing appear to have intensified efforts to find alternatives.

Banking in Washington

American-centered financial architecture is a huge source of power. Most international trades are in US dollars. Payments transfer through the Swift transaction system in which the US has immense influence. At the same time, financing by US-led investment banks Debts is done. They are rated by the rating agencies of this country and are even in charge of the major American credit affairs.

De-dollarization policy

The de-dollarization is the reduction of the dependence on the US dollar as a reserve and exchange rate currency. It is very challenging to confront it. The dominance of the US dollar over the international financial system is more than 75 years.

The dollar has maintained its strong position for three reasons:

- The large size of the US economy,

- The supported value of the US dollar by keeping inflation low

- An open and liquid financial market.

As the US economy shrinks relatively slightly, inflation spirals out of control, and financial markets are used as a weapon, the foundations for the stable role of the dollar are rapidly running out.

The financial partnership of China and Russia as the world’s largest energy importer and energy exporter is a necessary tool to eliminate the Oil Dollar dominance. In 2015, almost 90 percent of trade between Russia and China was in dollars, but by 2020, the dollar trade of the two Eurasian giants became halved to only 46 percent in dollars.

Russia has also been at the forefront of reducing the US dollar’s share of its foreign exchange reserves.

De-dollarization mechanisms of Chinese-Russian trade are also to end the US dollar use with other countries; As progress in this field has been seen in places such as Latin America, Turkey, Iran, India. The United States has been injecting its dollars into the world for decades. In some cases, the flow changes, and the dollar depreciates dramatically.

Financial transactions

Several other European countries have united by creating an alternative to Swift to limit Washington’s extraterritorial power and thus continue to trade with Iran.The Swift system used to be the only international payment system for conducting financial transactions between banks of the world. Swift’s central role was lost when the United States used it as a political weapon. The Americans first ousted Iran and North Korea from Swift, and in 2014 Washington began threatening Russia with expulsion from the system. Over the past few weeks, the threat of using Swift as a weapon against Russia has intensified.

China responded with CIPS and Russia with SPFS to replace Swift. Several other European countries have even joined forces by creating an alternative to Swift to limit Washington’s extraterritorial power to continue to trade with Iran. China and Russia’s new financial architecture should integrate CIPS and SPFS to make them more accessible to other countries. If the United States expels Russia from Swift, the separation from Swift will intensify.

Development banks

The International Monetary Fund (IMF), the World Bank, and the US-led Asian Development Bank are well-known instruments of US economic policy. The establishment of the Chinese-led Asian Infrastructure Investment Bank (AIIB) in 2015 marked a turning point in the global financial architecture as all major US allies (except Japan) joined and registered despite the US warnings. Formerly known as the BRICS Development Bank, the new development bank went further in breaking away from US-led banks. The Eurasian Development Bank and the Shanghai Cooperation Organization Development Bank are also more nails in the coffin of US-controlled development banks.

Synergistic effects

China and Russia have also developed their rating agencies, replacing the dominant Visa and MasterCard credit cards in their respective countries.

This new financial architecture is complemented by a partnership in energy and technology, as neither China nor Russia wants to depend on America’s high technology industries as they move toward the Fourth Industrial Revolution.

In addition, China and Russia are trying to move away from US-led transport corridors. China has invested trillions of dollars in its belt-and-road initiative for new land and sea corridors. Russia has developed a similar but simpler program that includes the development of the Arctic as a sea route, in partnership with China. The financing and management of such state-of-the-art programs, besides transportation corridors, will have a positive synergistic effect on the further development of the new international financial architecture.

The United States could use more sanctions to oppose the development of a multipolar international financial architecture. Yet the continued economic threats and coercion will only increase the demand for secession from the United States. The first rule of sanctions; if they are imposed, the target countries will learn to live without the hostile power. What began as an attempt to weaken and isolate Washington’s enemies eventually led to the isolation of the United States.

Mouood Mouood English Edition

Mouood Mouood English Edition